LONDON — The world economy will be in “deep kimchi” if the current trade war between the United States and China drags on, the finance minister of the Philippines has warned, acknowledging his country is one of the first in the firing line.

The Philippines sells around 15 percent of its goods to China. Its currency is down nine percent this year despite a run of interest rate hikes and growth has slowed to its weakest in three years.

The price of oil, one of its main imports, has risen over 80 percent in the last 15 months, fuelling worries about a dreaded fiscal and current account “twin deficit”.

“We are experiencing headwinds,” Carlos Dominguez told Reuters in London, having just announced his country will bring forward a $2 billion bond sale planned for January to next month, to try to beat any further rise in global lending rates.

“We have gone from the rumors of war to an actual trade war,” he said, adding rising U.S. rates and a stronger dollar were the main reasons for the slump in the peso.

“We have to go with the flow. There is no sense in fighting the current because if you do you may end up in a worse situation than when you started.”

Dominguez is also one of the rate setters at the country’s central bank, which is expected to jack up rates for a fourth straight meeting on Thursday. He will not be back in Manila for it but said he backed a “fact-based” decision on whether to hike.

His main worry is that rising oil prices will prolong the rise in inflation. The government has already subsidized public transport fuel costs.

He acknowledged a further rise in crude prices would compound the twin deficit risk and increase pressure on the peso. But he said moves to increase foreign exchange reserves in recent years had left Manila with at least seven months of import cover.

“At the moment it doesn’t seem too positive, with the U.S. raising interest rates, with emerging markets not being the darling of the moment and everybody is going into safe havens like the dollar and the yen,” Dominguez said.

“But we are ready, we have the necessary tools to manage the potential twin deficit situation.”

Trade uncertainty

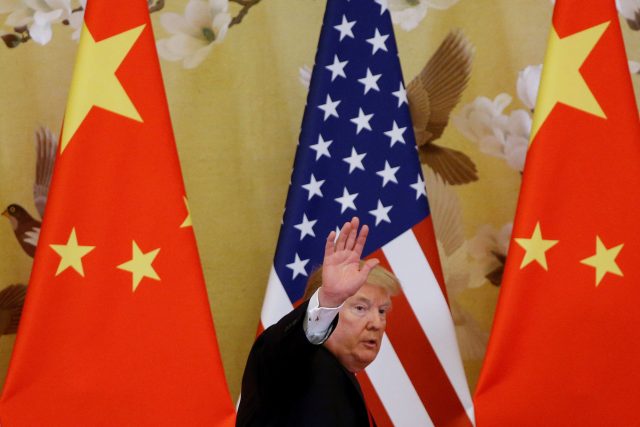

The other main uncertainty is the escalating trade war between the United States and China.

Dominguez said he had not seen evidence yet of Chinese firms hopping over to the Philippines to avoid Donald Trump’s 10-25 percent tariffs on their goods, but they have been exploring the country for a while.

There could be a short-term boost if China’s steel firms cut their prices to boost sales outside the United States. Manila is embarking on a six-year infrastructure drive that will require a lot of steel.

The longer-term picture is darker.

“China is our biggest trading partner now and if their GDP gets affected by this trade war, we are certainly going to feel it as well,” Dominguez said.

“At this point of time I can’t really say we will lose X percent but these are the items we are watching carefully.”

If the trade war drags on it could trigger tit-for-tat moves by economies around the world.

“Then all of us are in deep kimchi and I mean all of us, including the U.S.,” the minister said.

He remains hopeful it will not develop that way. One reason is that the Philippines has started talks about a free trade deal with Washington. He said it would also be more than happy to do one with Britain after Brexit.

“We are in early days talks with the U.S. for a free trade agreement,” he said. — Reporting by Marc Jones; Editing by Andrew Roche