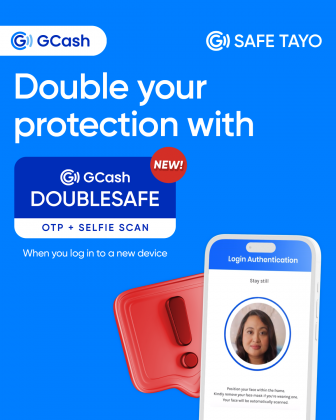

To add an additional level of security, GCash will now require its users to activate DoubleSafe.

Before DoubleSafe, GCash already required two levels of authentication or two-factor authentication. The first level of security is the one-time PIN (OTP), a unique number combination sent only to the user’s mobile number.

The second level is the Mobile PIN (MPIN), a four-digit passcode that only the customer or GCash owner should know.

To reinforce the security of customers’ accounts, GCash will now require all users to activate DoubleSafe in order to add an additional layer of security, starting this March. This feature will be activated for every first login to a new mobile phone to ensure the continued protection of its users.

The feature uses facial recognition, which means that even if a user inadvertently shares their MPIN and OTP to fraudsters, their account cannot be accessed from another device without scanning the owner’s face, ultimately preventing account takeovers.

GCash is also closely working with the Philippine National Police Anti-Cybercrime Group (PNP-ACG) in going after fraudsters and scammers. This was formalized by the signing of a memorandum of agreement in 2022.

“GCash is one with the PNP-ACG in making sure that these cybercriminals are put behind bars while reminding the public on how to safeguard their accounts,” GCash Head of Fraud Management Miguel Geronilla said.

“Together with the authorities, other relevant government agencies and our users, we can ensure that GSafeTayo.”

Along with the launch of Doublesafe, GCash is intensifying its GSafeTayo campaign through a series of awareness and education materials that will help customers identify and avoid fake sellers, suspicious links and other forms of scams.

The campaign focuses on providing prevention tips to help the public avoid being scammed:

- Don’t open unfamiliar links. Scammers often send messages with links, luring recipients with enticing “prizes” or a chance at a high-paying position. To counter this, GCash has stopped sending links via SMS, emails and other messaging apps.

- Never share personal information. It’s common practice for scammers to call individuals and pose as GCash representatives to gather personal user information. GCash will never ask its customers for MPINs and OTPs and will only reach out to customers through official channels.

- Double-check before buying. Fake online sellers and shops offer too-good-to-be-true deals to lure individuals into purchasing their products. GCash recommends double-checking online offers, as well as checking reviews to ensure authenticity.

“At GCash, the safety and peace of mind of our customers are very important to us. With DoubleSafe and our intensified GSafeTayo campaign, our users will be protected from scammers and account takeovers,” Geronilla said.

Through GCash’s unrelenting efforts to protect its users’ hard-earned money and the collective cooperation of its customers and partners, we can make sure that with GCash, #GSafeTayo.

To report scams and other suspicious activities, go to GCash Help Center via the GCash app or via https://help.gcash.com/, Chat with Gigi, and choose “I want to report a scam.”

Disclaimer: This branded content is not covered by Interaksyon’s editorial guidelines.