Banco de Oro, one of the largest private banks in the country, on Friday advised its clients of difficulty in accessing its online and mobile services amid the enhanced community quarantine.

The umbrella directive imposed over Luzon halted social activities and mass transportation as part of the national government’s measures to curb the spread of the novel coronavirus or COVID-19 in the country.

Filipinos were ordered to stay at home and only allowed them to leave their households for essential services.

Banking and other finance-related activities are among the essential services that remained operational and exempted from the nearly two-month lockdown in the region. However, several Filipinos now prefer the use of online and mobile banking services.

In view of this, BDO Unibank said there was a surge in logins and online transaction since the Luzon-wide quarantine was implemented last March 17. This subsequently led to some downtime on its mobile and online banking features.

It shared an infographic showing that the peak period of online transactions is from 10 am and 4 pm.

A surge in logins and transactions during the Enhanced Community Quarantine may cause difficulty in accessing BDO Online…

Posted by BDO Unibank on Thursday, April 16, 2020

Those with urgent banking needs are recommended to access the website before or after this period.

“We encourage you to log in before 10 am or after 4 pm,” BDO said in its advisory.

“We understand your banking needs are urgent and are working hard to improve our accessibility during these trying times,” it added.

Several Filipinos took to social media to express their disappointment and frustration over the inconvenience of their online services or the lack thereof.

Does BDO means B-ank that D-isappoints you O-nline?

Hey BDO online banking, shape up! We badly need you!

— Gerald Joseph Malit (@geraldmalit) April 16, 2020

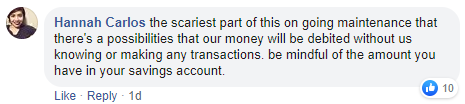

Others raised concern on whether their money has been debited or not due to the constant downtime of their website.

“The scariest part of this ongoing maintenance that there’s a possibility that our money will be debited without us knowing or making any transactions. be mindful of the amount you have in your savings account,” a Facebook user said.

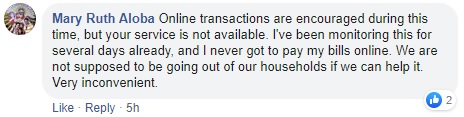

A Facebook user stressed the importance of online banking amid the strict travel restrictions under quarantine rules.

“I’ve been monitoring this for several days already, and I never got to pay my bills online. We are not supposed to be going out of our households if we can help it. Very inconvenient,” the online user commented.

Aside from the issues that the online banking presented, Filipinos were also warned against the prevalence of phishing, a cybercrime that lure victims into providing sensitive data such as banking and credit card details.

The Bangko Sentral ng Pilipinas advised Filipinos to be cautious of giving personal information through text messages, emails and websites posing as financial institutions.

“Ang mga ito ay maaaring naglalaman ng mga phishing links o attachments na maaaring makuha at nakawin ang inyong mga personal financial/banking information,” BSP said on April 7.

“Hindi kailanman manghihingi ng inyong personal/financial information ang BSP, mga bangko at iba pang financial institutions,” it added.

BSP ADVISORY⚠️ Paalala mula sa Bangko Sentral ng PilipinasMAGING ALERTO: Mag-ingat sa mga texts, emails o websites…

Posted by Bangko Sentral ng Pilipinas on Tuesday, April 7, 2020

Filipinos can still avail of financial transactions at select branches of local banks such as BDO Unibank, Bank of the Philippine Islands and Philippine National Bank, among others. The operating hours of these banks are posted on their respective social media accounts.

The Bankers Association of the Philippines last week expressed commitment to serve its clients during the entire duration of the enhanced community quarantine.