Asia, the epicenter of growth for oil and gas demand globally, is the region most vulnerable to any disruption in supply from the Gulf in the event of further escalation in the war of words between Iran and the United States in Iraq.

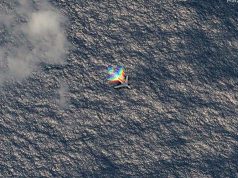

Most of Iraq’s crude oil exports from its southern Basra ports head to Asia, according to Refinitiv data. And an estimated 76% of the 17.3 million barrels per day (bpd) of crude and condensate that flowed through the Strait of Hormuz in 2018 went to Asia, according to the U.S. Energy Information Administration (EIA).

Asian refiners prefer to process Middle East crude grades as they are generally cheaper than oil from other regions due to relatively higher sulfur levels. Middle East oils also tend to be heavier grades, allowing refiners to further process residue fuel into higher-value products to boost revenue.

The United States used to be a major importer of oil from the Middle East but its share has steadily declined in recent years on the back of its own shale oil boom.

In 2018, U.S. oil imports passing through the Strait of Hormuz stood at 1.4 million bpd of oil and condensate, accounting for about 18% of total U.S. crude and condensate imports and 7% of total U.S. petroleum liquids consumption, according to the U.S. government.

Here’s a breakdown of Middle East crude oil and liquefied natural gas (LNG) imports for each major Asian importing country.

China

China, the world’s largest crude oil importer, buys about 40% of its crude from the Middle East. While China’s imports are diversified, it is the largest Middle East oil buyer globally, at just over 4 million bpd.

India

The second-biggest Asian oil importer gets nearly 60% of its crude supplies from the Middle East. It is also the largest buyer of crude from Iraq, at just over 1 million bpd in 2019.

Japan

Japan has one of the highest proportion of Middle East oil in its imports at 88.5% for the first 11 months of 2019.

“Our policy is to keep a big stockpile so, even if the Middle East has a big disruption, as long as we have these reserves we will be OK,” a senior official from Japan’s trade ministry told Reuters. “We have enough supplies to last 200 days.”

Rest of Asia

Despite efforts to diversify purchases beyond the Middle East, South Korea, Singapore and Taiwan still need to import 70-75% of their crude from the Gulf.

In southeast Asia, nearly half of Indonesia’s oil imports come from the Middle East, while almost all of Vietnam’s crude imports to feed the country’s second refinery are from Kuwait.

Middle East crude accounted for 73% of Philippines‘ imports in the first half of 2019, government data showed.

LNG

Top three destinations for LNG from Qatar – the world’s top exporter – are South Korea, India and Japan, but those most reliant on Qatari LNG are Bangladesh, Pakistan and India.—Reporting by Xu Muyu in Beijing, Jane Chung in Seoul, Aaron Sheldrick in Tokyo, Nidhi Verma in New Delhi, Wilda Asmarini in Jakarta, Khanh Vu in Hanoi, Enrico Dela Cruz in Manila and Shu Zhang, Jessica Jaganathan, Florence Tan and Gavin Maguire in Singapore; Editing by Kenneth Maxwell and David Evans