Former Pasig City Mayor Robert “Bobby” Eusebio shared that the city received a “qualified opinion” status from the annual audit report as released by the Commission on Audit.

In his Facebook page, he thanked the state audit agency, saying that the status meant the city fulfilled one of the minimum requirements for the Seal of Good Local Governance recognition given by the Department of Interior and Local Government.

“Matapos ang masusing pag-aaral ng Commission on Audit (COA) hinggil sa pinansiyal na posisyon ng ating lungsod at pati na rin sa paraan ng pamamalakad ng lokal na gobyerno, ang atin pong lungsod ay nakakuha ng ‘Qualified Opinion’ para sa taong 2018 ng COA,” part of his post reads.

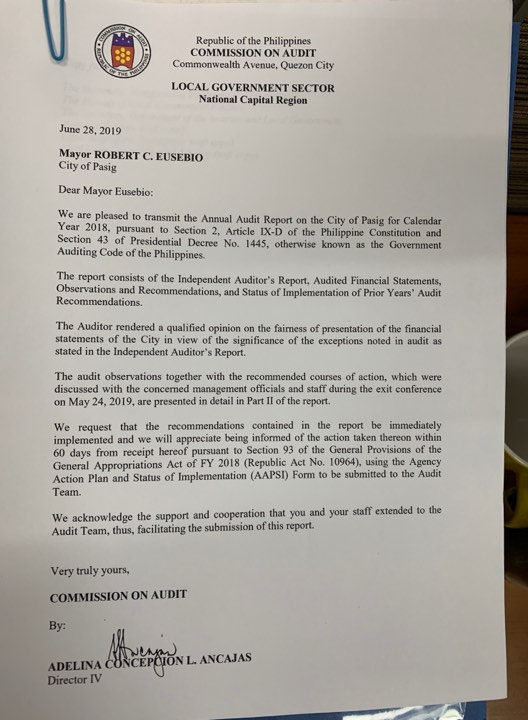

COA in the letter said that Pasig City attained a “qualified opinion” status for its annual audit report in 2018. Part of it reads:

“The Auditor rendered a qualified opinion on the fairness of presentation of the financial statements of the City in view of the significance of the exceptions noted in audit as stated in the Independent Auditor’s Report.”

It added, however, that the city should “immediately” implement the agency’s recommended courses of action “within 60 days” following the latest result of the audit report.

There were some Facebook users who gave laudatory comments to Eusebio for the audit result.

“Congrats po, Mayor Bobby! Pasigueños are truly proud of you! God bless po!” a Facebook user wrote.

“I have always known that you will always do the right thing, Mayor,” another user commented.

There were also those who argued that the result should not be something the former mayor should be proud of.

Former Mayor Bobby Eusebio celebrating the qualified opinion which the COA rendered on its report is one of the best jokes of this year. One, an audit opinion is not an award. Second, qualified opinion is not a good thing. 😅

— Hussein Balt (@husseinbalt) July 1, 2019

A Facebook user claiming to be an accounting graduate and a certified public accountant wrote that the result “is not a good thing.”

“FYI: Hindi po kagandahan ang qualified opinion! ‘Pag wala kang misstatements in all material respect sa FS (financial statement) ay unqualified opinion ang ibibigay. You’ve got it all wrong! PS: I’m a BSA, CPA, MBA, DBA, just so people know I’m not talking nonsense here,” he commented.

Some users also alleged that the administrator of his Facebook page has been “deleting” comments that appeared to be critical of the post.

“Kanina 770 ‘yung comments, now 743 na lang, delete pa more! Bakit ‘di na lang kayo mag-sorry for the misinformation at sabihin na gagawin lahat in 60 days para mapasa ‘yung mga requirements,” a user wrote.

A look at audit reports

The Commission on Audit is tasked by the Philippine Constitution to “examine, audit and settle all accounts” of expenditures or uses of funds owned by the government and its subdivisions.

It is mandated to release annual audit reports of government agencies and offices, including local government units.

An audit report is a written opinion of an auditor about an entity’s financial statements.

It offers a third-party perspective on the financial performance of an agency and provides a “more comprehensive insight” on how it spends money from an unbiased point of view.

There are generally four types of audit reports. It can be of unqualified, qualified, disclaimer or adverse opinion, according to a private accounting firm.

An unqualified opinion, also known as the “best possible audit outcome,” means the agency’s financial statements conform to the Generally Accepted Accounting Principles and that it is reported fairly.

A qualified opinion means the agency fulfilled some parts of the GAAP, although there are some matters to be taken into consideration.

Based on Business Case Analysis, it may stem from the following circumstances:

- The report misstates or misclassifies accounting entries. For example, an expense that should appear above the gross profit line appears wrongly below it. This error can lead to misleading gross profit figures.

- There are limits on audit scope which means the auditors may not have had access to particular financial data.

- The auditor doubts the veracity of specific financial data.

- The auditor is not entirely confident that the reports comply with GAAP and/or represent the entity’s accounts fairly.

A private accounting firm notes that this type of opinion means the agency may not have presented its financial statement “in accordance with GAAP.”

A disclaimer opinion, on the other hand, means that the auditor is unable to express a definite opinion on the report “due to the lack of properly maintained financial records or the absence or insufficient support from the management,” among others.

An adverse opinion is when the auditor believes there has been “a gross misstatement and, possibly, fraud, in the preparation of the of the company’s financial records.”