NAGOYA, JAPAN — Facing the eventual demise of gasoline engines, the world’s biggest maker of spark plugs is turning its focus to a component it believes will be just as vital in the coming era of electric vehicles – next-generation all solid state batteries.

Japan’s NGK Spark Plug Co has for years leveraged its expertise in ceramics technology used in spark plugs to expand into sensors, semiconductors and other products mainly for automobiles.

Now, it sees a future in all solid-state batteries, which experts believe will be safer and more powerful than the lithium-ion batteries currently used in battery electric vehicles (EVs).

After dominating transport for 150 years, the internal combustion engine is facing the end of the road in the coming decades as tightening global emissions regulations force automakers to develop more electric cars.

“We realised that it was inevitable that the industry would at some point shift from the internal combustion engine to battery EVs, and that ultimately this could make our spark plug and oxygen sensor businesses obsolete,” Takio Kojima, senior general manager of engineering and R&D at NGK Spark Plug told Reuters in an interview.

“Our expertise is in advanced ceramics, and so we have decided to pursue all solid-state batteries.”

Established in 1936 and based in Japan’s automaking heartland of Nagoya, NGK Spark Plug’s realisation that its main business faced obsolescence came around 2010, Kojima said.

That was the year Nissan Motor Co rolled out the Leaf, the first mass-production all battery EV, and just after Tesla Inc came out with the Roadster, its first production car.

Other global parts suppliers are also scrambling to overhaul their product portfolios.

In Japan, Denso Corp has teamed up with Toyota Motor Corp and Mazda Motor Corp to develop battery EVs while transmission maker Aisin Seiki Co is developing hybrid transmission systems and EV-specific, four-wheel-drive units.

In the United States, powertrain products maker Borg Warner has expanded into hybrid and electric car parts, including transmissions and drive modules for electric cars.

Industry experts anticipate plug-in hybrid petrol-electric vehicles and all-battery EVs will account for as much as 26 percent of global car sales by 2030, versus just over 1 percent last year, data from the International Energy Agency shows.

Going big

The rise in EV use will require a steep increase in manufacturing capacity for longer-life batteries which are more powerful, lighter and can charge quicker than conventional lithium-ion batteries.

NGK Spark Plug joins Toyota and other companies developing all solid-state car batteries, which offer more capacity and better safety than conventional lithium-ion batteries by replacing their liquid or gel-like electrolyte with a solid, conductive material.

Toyota is developing batteries with sulphide-based solid electrolytes, which offer high conductivity and are relatively flexible but can release toxic hydrogen sulphide when exposed to moisture.

NGK is betting on a different technology with an oxide-based chemistry using ceramics which is highly stable at extreme temperatures, but has less conductivity. In addition, brittle ceramics can be difficult to process.

Japan’s TDK Corp has developed small, ceramic, all solid-state batteries for use mainly in wearable devices like personal fitness monitors, while Murata Manufacturing Co is developing similar products.

But NGK Spark Plug has bigger plans, developing a larger format necessary for cars.

“It’s relatively easy to work in smaller sizes, but when you get to larger sizes it gets very difficult to assemble each layer because it’s difficult to make each layer the same thickness,” said Hideaki Hikosaka, a member of NGK Spark Plug’s solid state battery R&D team.

The company has spent the past five years developing a solid, oxide-based electrolyte which incorporates an additional material to make it resemble a sulphide-based one.

This makes the electrolyte easier to process into larger, thin layers which are compressed, making them easier to stack with anodes and cathodes.

“It’s because of the addition of that material that we’re able to process layers using compression (rather than sintering) to make a bigger, oxide-based battery cell. At the same time, it doesn’t release any gases like sulphides do,” Hikosaka said.

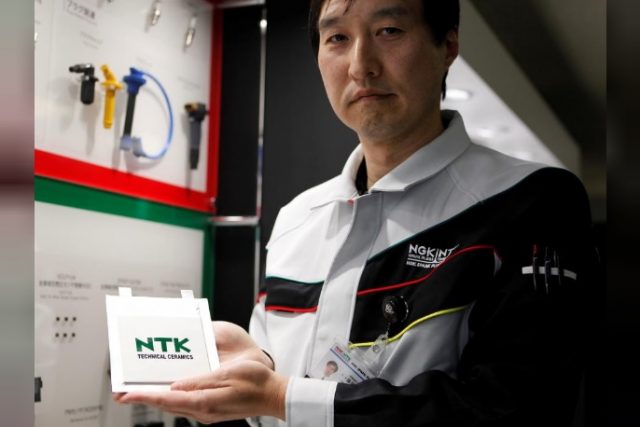

As a result, the company has developed a 10 cm by 10 cm battery pouch cell, much bigger than 4.5 mm by 3.2 mm cells developed by TDK.

NGK Spark Plug declined to comment on the material used in its oxide compound and the capabilities of its battery.

Hikosaka said his team was working to raise the battery’s energy density to enable it to match the performance of lithium ion batteries by around 2020, and to develop more powerful, lighter and competitively priced batteries “in the 2020s”.

Battery experts believe producing affordable, all solid-state batteries in the 2020s, a target also shared by Toyota, is ambitious given the challenges of achieving a fine balance between numerous performance characteristics.

Once they do come to market, some experts believe competition between batteries based on oxides, sulphides, and other chemistries would likely heat up, as producers vie to deliver batteries with diverse specifications.

“If these chemistries can compete and win against lithium-ion and we see a shift to all solid-state, we might see a diversification in the materials used in them, as in lithium-ion batteries,” said Venkat Srinivasan, director of the Argonne Collaborative Center for Energy Storage Science in Illinois.

“Some automakers and battery makers might be more interested in conductivity than oxidative stability, for example … Batteries are all about compromise. You’re not going to hit every metric.”