The year 2023 will be remembered as turbulent for cryptocurrencies, with numerous important developments that ultimately helped to “clean up” the space to potentially make it more attractive to mainstream investors. Notably there was the conviction of FTX CEO Sam Bankman-Fried for fraud.

Top exchange Binance also reached a US$4 billion settlement (£3.1 billion) with the US treasury department over money-laundering charges, which saw CEO Changpeng “CZ” Zhao agreeing to step down and pay a US$50 million fine.

Meanwhile, regulators continued cracking down on other operators, but potentially lost one of their key cases against the industry after a US court ruled that the XRP token, one of the top ten cryptocurrencies, was not a security (meaning a tradeable financial asset like shares or bonds).

This means its creator, Ripple, did not break the law by selling it on exchanges. Viewed as a test case for the majority of cryptocurrencies, the US Securities Exchange Commission (SEC) is currently appealing.

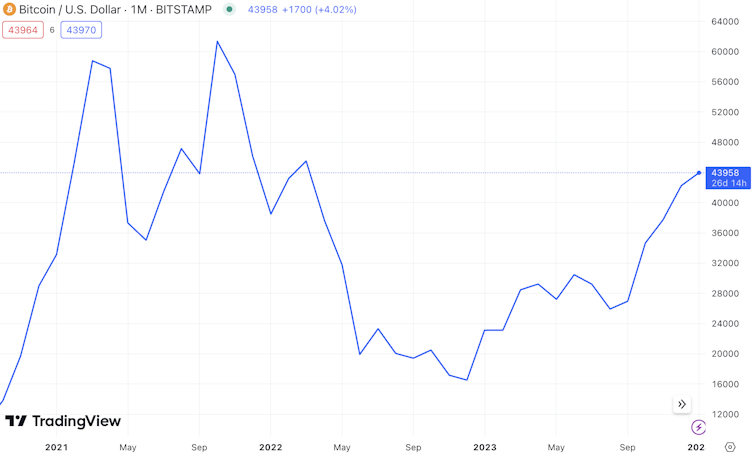

While all this was happening, the bitcoin price rose away from the lows of late 2022. It started the year at US$16,000 and ended comfortably above the US$40,000 threshold.

So what does 2024 look like for this sector and what key events are on the horizon?

1. ETFs

The SEC may finally be about to greenlight a type of investment vehicle known as an exchange traded fund (ETF) for the for the general or “spot” bitcoin market. ETFs already exist for everything from oil to the FTSE 100 to even regions and countries. They track the underlying asset, creating an easy way for people to invest without having to buy the asset directly.

Until now, the only ETFs permitted for crypto in the US have been for the futures markets. These niche markets are concerned with where investors think crypto prices are heading in future.

Bitcoin price 2021-24

A spot bitcoin ETF would likely encourage mainstream investors to buy exposure to this market, while potentially attracting banks to actively participate too. Bitcoin could be offered by financial advisors and there would no longer be a need for investors to hold the asset itself or face difficulties like crypto exchanges, coin storage and so on.

There are various reasons why many commentators think the SEC may now end its opposition to such an ETF. For one thing, the list of applicants includes Blackrock, the biggest investment house in the world, along with various other major players.

Also, digital asset group Grayscale won an important case against the SEC in 2023, which had been blocking its attempt to convert its US$17 billion bitcoin futures ETF, GBTC, into a spot version. This has forced the SEC to reconsider Grayscale’s application too.

Further, Hong Kong’s regulatory authority has announced it is open to spot bitcoin ETF applications and has laid down guidelines permitting several varieties. As well as the basic model that we may soon see in the US, where investors would buy into bitcoin ETFs with dollars, Hong Kong is open to a second variety known as “in-kind”.

This would make it possible to convert shares in a bitcoin ETF into bitcoin and vice versa, allowing more flexibility and potentially attracting more institutional investors into the space.

2. Interest rates

Jerome Powell, chair of US central bank the Federal Reserve, has indicated that interest rates may have peaked, and that the Fed is likely to cut them during 2024. Similarly in the UK, leading mortgage lender Halifax has cut its lending rate in expectation of a Bank of England rate cut.

If interest rates are cut or even stabilise in 2024, it could make bitcoin (and other digital assets) more attractive to investors, since its limited supply makes it a hedge against traditional currencies losing value over time.

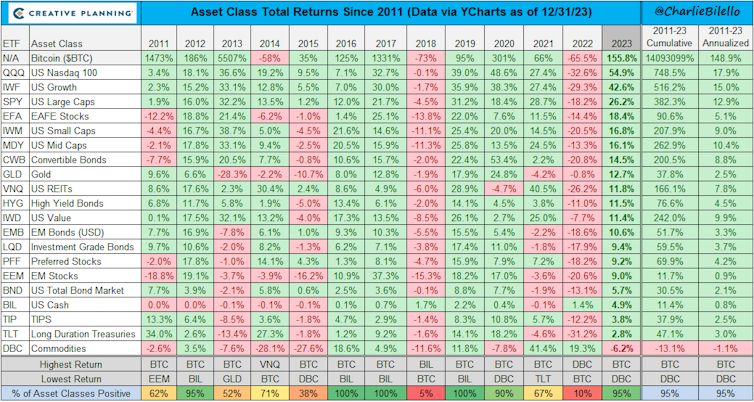

More generally, rate cuts prompt investors to look for higher investment returns, and cryptocurrencies have delivered here too.

Asset class returns since 2011

In addition, the US and other economies may enter a recession in the later half of 2024 due to the lagged effects of the interest rate hikes.

Equally, we saw a number of bank failures in 2023, predominantly in the US. In the event of a recession or more bank problems, governments may be forced to provide stimulus packages and print more money. This would further devalue currencies and make bitcoin still more attractive.

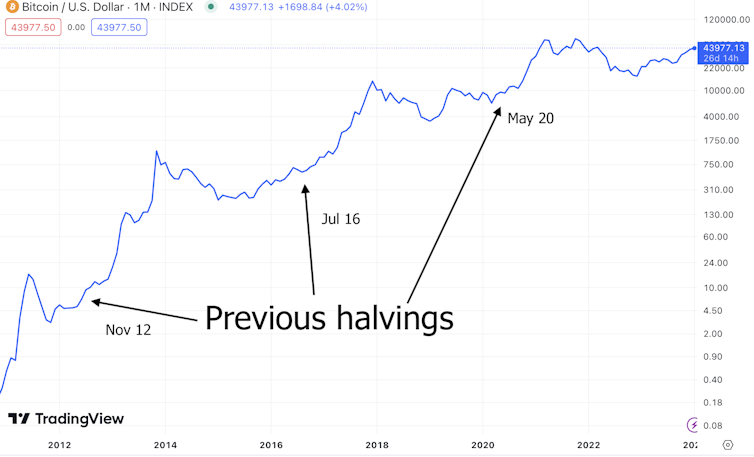

3. The halving

A big event for bitcoin in 2024 is the so-called “halving”. Bitcoin runs on an online ledger known as a blockchain, in which entries are validated by “miners” using arrays of computers to solve complex mathematical puzzles. Miners are paid in bitcoin for completing a set of transactions known as a block, and the protocol stipulates that their reward per block halves every 210,000 “blocks” (roughly every four years).

The reward began at 50 bitcoin in 2009 and is expected to fall from 6.25 bitcoin to 3.125 bitcoin around the middle of April 2024.

This decrease entails fewer bitcoin sold on the market, which tightens supply and may squeeze out the least efficient miners, significantly reducing the computer power used by the network. The three previous halvings have prompted dramatic bull runs, while also driving up the prices of digital assets more generally as investors take more risks in the space.

Halving effects

4. Blockchain developments

The bitcoin network saw a number of technological advancements in 2023. This has included enabling a new and a unique form of NFTs (non-fungible tokens) known as ordinals, and also a new standard called BRC-20 that makes it possible to create new cryptocurrencies on the network. Until now, NFTs and new cryptocurrencies have mostly been issued on other blockchains such as ethereum.

We are also seeing growing adoption of the Lightning network, a layer above the bitcoin blockchain that enables much faster transactions. All these changes are resulting in increased demand for bitcoin, which in turn may lead to higher prices.

In sum, there’s a strong case for being bullish about bitcoin’s price in the year ahead. Commentators’ predictions range from US$60,000 to US$500,000 by year end. Our own belief is that though the road may be bumpy, 2024 could well see increased adoption of cryptocurrencies, which will drive prices beyond the current US$40,000 mark.![]()

Andrew Urquhart, Professor of Finance & Financial Technology, ICMA Centre, Henley Business School, University of Reading and Hossein Jahanshahloo, Assistant Professor in Finance, Cardiff University

This article is republished from The Conversation under a Creative Commons license. Read the original article.