MANILA – The government raised 1.46 billion renminbi (RMB) on Tuesday from its maiden “panda” bond sale amid “overwhelming demand” from both offshore and onshore investors, the Investor Relations Office (IRO) announced in a press statement on Tuesday.

The offer of the three-year debt papers was more than six times oversubscribed at 9.22 billion RMB against the 1.46 billion RMB that the government placed on the auction bloc.

“With a tight spread of 35 basis points (bps) above benchmark (China Development Bank three-year notes’ 4.65%), the three-year Panda bonds fetched a coupon rate of 5.00%,” the government’s IRO said in its statement, noting that offshore investors accounted for 87.7% of the offer.

“The Philippines was able to diversify its investor base with participation originating from both onshore and offshore investors.”

The IRO cited a 5.00-5.60% price range prior to the auction, saying that “overwhelming demand” kept the coupon at the low end.

It described the offer’s oversubscription as “the all-time largest coverage for any panda sovereign issuer.”

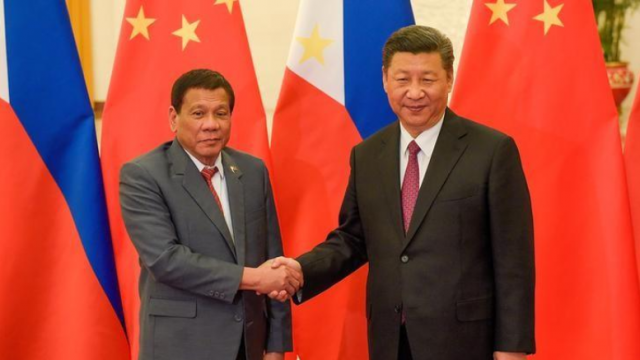

“The Philippine government’s successful inaugural issuance of panda bonds highlights the investor confidence that the country enjoys on the back of its strong credit profile,” the statement quoted Finance Secretary Carlos G. Dominguez III as saying, describing the successful auction as “one of the concrete results of President (Rodrigo R.) Duterte’s foreign policy.”

Mr. Duterte had startled the country’s traditional partners by announcing in a speech during an October 2016 visit to Beijing, China — shortly after he took office at end-June that year — his “separation” from the United States and pivot to China and Russia. His economic managers scrambled to whip up a press statement by noon the following day that Mr. Duterte was merely referring to an independent foreign policy.

The maiden panda bond sale followed a March 14-16 road show in Singapore, Hong Kong and China that was led by National Treasurer Rosalia V. de Leon and Bangko Sentral ng Pilipinas Deputy Governor Diwa C. Guinigundo.

China-based Lianhe Credit Rating Co. Ltd gave the yuan-denominated bonds an “AAA” rating and stable outlook, noting that the debt issue has the “lowest expectation of default risk.”

Panda bond sale proceeds will be converted to pesos and will help fund the government’s infrastructure projects and other financing requirements. The government is embarking on an P8-trillion infrastructure spending program until 2022, when President Rodrigo R. Duterte ends his six-year term, in an effort to boost economic growth to 7-8% until then, from 6.7% recorded in 2017 and the 6.3% average logged in 2010-2016. The government plans to borrow P888.23 billion this year to plug its budget deficit capped at three percent of gross domestic product. — Elijah Joseph C. Tubayan