MANILA – Beneficiaries of the government’s conditional cash transfer (CCT) program receiving subsidies through automated teller machines (ATMs) will get additional funds starting this February to alleviate the impact of higher prices of some commodities due to tax reform.

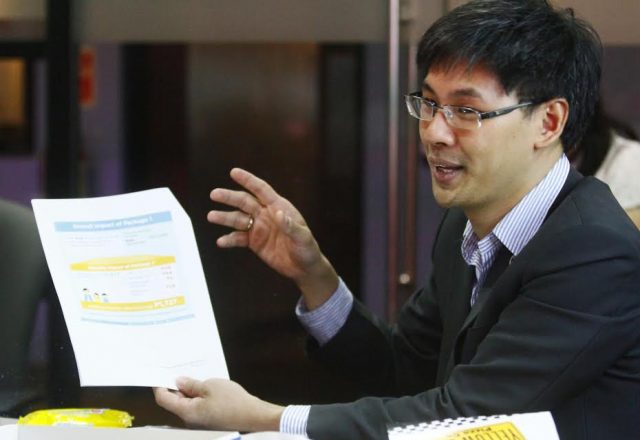

Finance Undersecretary Karl Chua said beneficiaries of the Pantawid Pamilyang Pilipino Program (4Ps), who receive subsidies through over-the-counter mode, would get their top-up starting March while the additional beneficiaries, who belong to the lower 50 percent bracket of the society, would get theirs starting July.

He said some 7.2 million beneficiaries of the subsidy would get their funds in the first quarter this year.

The remaining 2.8 million households who are still being registered with the Department of Social Welfare and Development (DSWD) will get theirs in July but Chua said the amount to be disbursed by then would be equivalent to the full-year budget augmentation amounting to PHP2,400.

The first package of the Tax Reform for Acceleration and Inclusion (TRAIN), which took effect January 1, 2018, cuts workers’ income tax rates and gives workers’ first PHP250,000 annual income a tax-free rate. It also hiked excise taxes on fuel products and sugar-sweetened beverages, among others, to counter the impact of the tax cut on government revenues.

The excise tax hikes on some commodities are seen to impact the poor, thus, the program to provide a one-year subsidy to the lower 50 percent bracket of the society.

Some of them have been given Land Bank of the Philippines (Landbank) accounts where they receive the subsidies, while others get them through conduits such as cooperatives and rural banks.

Under TRAIN’s first package, about 40 percent of the proceeds from higher excise taxes will be used for social mitigating measures such as targeted cash transfers to poor families, subsidies to drivers and operators of public utility vehicles (PUVs) and electricity consumers in Small Power Utilities Group (SPUG) areas or those that are not connected to the main power grids.