MANILA – The Department of Finance (DoF) hopes to secure midyear approval by the House of Representatives of the second tax reform package in order to start enforcement in January 2019, even as the head of the committee that will shepherd the measure through the chamber said it would be “difficult” to stick to such a timetable.

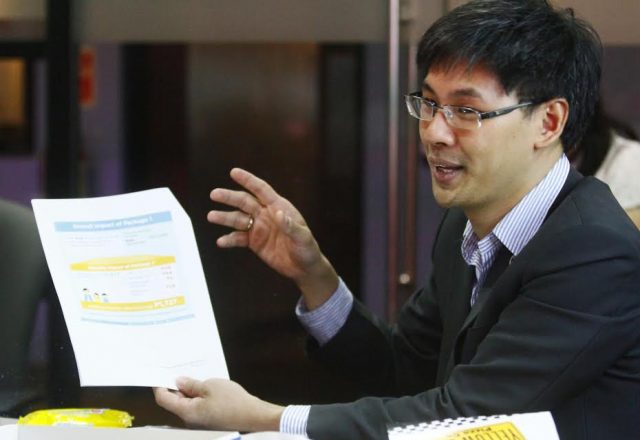

“Hopefully by midyear,” Finance Undersecretary Karl Kendrick T. Chua said in a mobile phone message when asked when the department wants the House to approve the second of up to five planned tax reform packages that was submitted to the House last week.

He added that the DoF hopes to have the measure take effect by “January 2019.”

House ways and means committee chairman Rep. Dakila Carlo E. Cua of Quirino, however, was cautious when asked for a preliminary timetable.

“We had an overview briefing [on Wednesday]. I am awaiting further submissions from DoF in order to have an in-depth understanding of the bill,” he said, referring to “TIMTA (Republic Act No. 10708 or the Tax Incentives Management and Transparency Act) data that can give light to some cost-benefit analysis of the existing fiscal incentive programs of the government”

“Filing (of the bill) will come after then.”

Informed of the Finance department’s hope for midyear approval by the House, Mr. Cua remarked: “It’s difficult, but possible.”

“I hope DoF will supply the necessary data soon and collaborate closely.”

The Constitution provides that all tax measures must originate from the House of Representatives.

The DoF submitted the second package to the House on Jan. 15 which seeks to cut corporate income tax rates to 25% from 30% currently to match those of the Philippines’ Southeast Asian competitors, while withdrawing fiscal incentives from firms that do not need them.

To recall, the first package — enacted on Dec. 19 as RA 10963 that cuts personal income tax rates and hikes or imposes sales taxes on various items — was submitted to Congress in September 2016, filed as a bill in January 2017, approved in the House — after enduring what President Rodrigo R. Duterte described as “resistance” and “rough sailing” — on May 31 and in the Senate on Nov. 28.

RA 10963 is now estimated to yield some P90 billion in additional revenues in the first year of enforcement, compared to P133.8-157.2 billion originally.