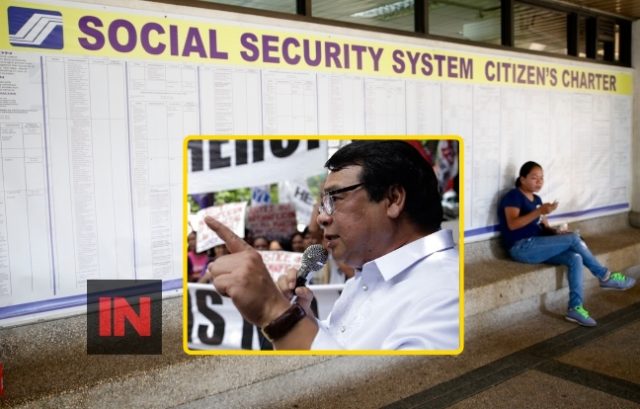

MANILA, Philippines – Former partylist representative Neri Colmenares on Tuesday questioned the plan of the Social Security System (SSS) to impose a 14 percent increase in member contribution to the pension fund, and instead demanded a report from SSS on its collection efficiency.

Colmenares, who is chairman of the Bayan Muna political action organization, said SSS management should not train its sights on increasing contributions on grounds that members now enjoy higher take-home pay due to the Tax Reform for Acceleration and Inclusion (TRAIN) law.

“This is misleading, because not all workers would have increased take-home pay because of TRAIN. Besides, the majority of workers would be burdened by additional living costs due to higher excise taxes on numerous expense items occasioned by TRAIN,” he said.

“As it is, wages remain low while prices are surging. Announcing a contribution increase right now is the last thing that SSS should do,” he added.

SSS president and chief executive officer Emmanuel Dooc recently announced that the pension fund management intends to increase the contribution rates following the implementation of TRAIN law.

Dooc said the state fund was looking at a three-point increase this year, which meant the monthly contributions of its members will rise to 14 percent of their monthly salary credit, up from the current 11 percent.

Colmenares said SSS management should instead improve collection efficiency from the employers of the 31 million members; collect the billions in contributions that delinquent employers failed to remit in the last 10 years; cut down in bonuses and perks given to its board members and collect the disallowed retirement packages given to them in 2009; and, collect the fines imposed by the courts against employers who violated the SSS law.

Currently, Colmenares said SSS collects contribution from only 12 million of its 31 million members.

“If only SSS is able to collect these, then even the base pension increase can be funded without need for hiking contributions. If they improve their investment efficiency and maximize income from their investments, SSS funds will be more than enough to fund additional pension increases,” he said.