MANILA – Employees of regional operating headquarters (ROHQs) need not worry about the veto of the provision under the first tax reform package that allows them to continue enjoying the 15 percent preferential withholding tax rates because they will benefit from lower income taxes in general.

This was pointed out by Finance Undersecretary Antonette Tiongco, who said the veto on such provision affects only few employees of ROHQs, which are mostly companies belonging to the business process and outsourcing (BPO) sector.

Tiongco said almost 90 percent of ROHQ employees will benefit from the cut in personal income tax set under the first package of the Tax Reform for Acceleration and Inclusion (TRAIN) Act.

“In fact the ones that qualify for the 15 percent rate are those earning P975,000 and up (who are the) high-earning people and they enjoy lower rates,” she said.

The Department of Finance (DOF) official said high- earning individuals who hold managerial positions are the ones who are questioning the veto.

She explained that employees of ROHQs, which were previously called RHQs, were given preferential rates because these entities were not supposed to have incomes.

She said RHQs previously served only as coordinating centers and did not earn income.

However, these have evolved with some BPOs now structured as RHQs, thus the change in name to ROHQs and the change in tax rate of their employees for the government to properly tax them.

Previously, workers with annual income of P500,000 and up were taxed 32 percent.

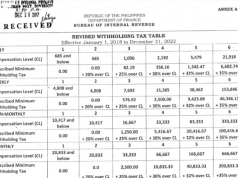

Under TRAIN, which took effect Jan. 1, 2018, annual income of P250,000 and below is now tax-free.

Tax rates of those with higher than P250,000 up to P400,000 annual income are 20 percent of the excess over P250,000; P30,000 plus 25 percent of the excess over P400,000 for those earning above P400,000 to P800,000.

For those earning more than P800,000 to P2 million, the rate is P130,000 plus 30 percent of the excess over P800,000; for those earning P2 million up to P8 million, the rate is P490,000 plus 32 percent of the excess of over P2 million; and for those earning P8 million and up, the tax rate is P2.41 million plus 35 percent of the excess of over P8 million .