MANILA – The Bureau of Internal Revenue has formally circularized the new computation of the withholding tax to be deducted from salaries starting in January 2018 to comply with the new individual income tax provisions of the TRAIN Law.

The timely issuance was praised by Leyte 2nd District Rep. Henry Ong, who earlier requested the BIR to issue this guidance to the field and the general public so the additional personal disposable income effects of the TRAIN tax reform will be immediately felt starting the first payday of 2018.

Ong, Vice Chair of the Committee on Banks and Financial Intermediaries, said in a press statement on New Year’s Eve, “I commend the BIR for their efficiency and swift action.”

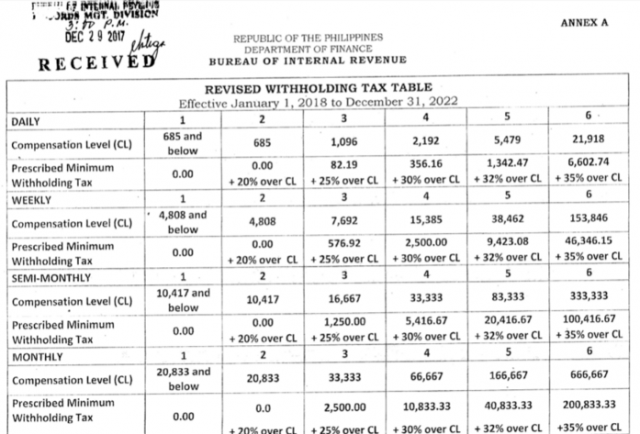

Revenue Memorandum Circular 105-2017 issued Dec. 28 by BIR Commissioner Caesar Dulay directed all internal revenue officers to ensure that, beginning January 1, 2018, “every employer making compensation payments to their respective employees shall deduct and withhold from such compensation a tax determined in accordance with the Revised Withholding Tax Table” issued by his office.

This will ensure, Dulay said, “that a smooth transition as to the tax rates” following enactment of Republic Act 10963, or the Tax Reform for Acceleration and Inclusion (TRAIN), is ensured.