(UPDATE — 11:02 p.m.) MANILA, Philippines — As its final act before adjourning for the year, the House of Representatives ratified late Wednesday the bicameral conference committee version of the Tax Reform for Acceleration and Inclusion (TRAIN) bill, the first tax measure under the Duterte administration.

The ratification came despite objections raised by ACT Teachers partylist Representative Antonio Tinio for lack of quorum. Not more than 20 lawmakers were on the floor during ratification. Session was immediately adjourned.

An hour later, the Senate, which earlier suspended deliberations on the bicameral conference committee report, finally conducted nominal voting on the tax reform package and ratified it by a vote of 16 in favor and four against.

The negative votes were cast by Senators Ping Lacson, Risa Hontiveros, Bam Aquino and Antonio Trillanes IV.

Voting for the TRAIN were Senators Sonny Angara, Nancy Binay, Frank Drilon, JV Ejercito, Chiz Escudero, Win Gatchalian, Dick Gordon, Gringo Honasan, Loren Legarda, Joel Villanueva, Koko Pimentel, Grace Poe, Ralph Recto, Tito Sotto, Cynthia Villar and Migs Zubiri.

EXCISE ON COAL

Deputy Speaker Romero Federico Quimbo, one of the members of the House contingent in the bicameral panel, said coal will be imposed only with excise tax.

“The final version was coal was excisable, which is the very same agreement we had in the bicam,” he told InterAksyon.com in a phone interview.

“Coal will not be exempt. It will be subjected to a new excise tax that is 500 percent higher than before the TRAIN,” he added.

Under the TRAIN proposal, coal manufacturers, both local and foreign, will pay the excise tax of P50 per metric ton in the first year of implementation; P100 in the second year; and, P150 in the third and succeeding years.

Under Presidential Decree No. 972, the current law in place, local coals are exempt from any form of tax, including excise tax, value added tax and customs duties.

The TRAIN bill will impose only the excise tax on coals. Sources have said that the Senate panel wanted to lift the exemptions on taxes being enjoyed by coal manufacturers under the Presidential Decree.

Asked why the House contingent did not include the imposition of VAT, customs duties and other taxes, which the manufacturers are currently not paying, Quimbo explained, “What we passed today is tax on income and indirect taxation. The other aspects would be covered by the next phase of the tax reform.”

He added, “What we signed, and which we gave to the Senate contingent, was the one agreed last night.”

PACKAGE 2 OF TRAIN

In a separate interview, Quirino Rep. Dax Cua, chairman of the ways and means committee, reiterated the imposition of VAT and other taxes on coal manufacturers would be taken up in the package 2 of TRAIN.

He also said that the final version was a product of thorough discussions between the panels.

“For the same reason that we kept the VAT exemption on renewable energy . . . these are both part and parcel of a wide-range of discussions on fiscal incentive,” he said.

One of the contentious provisions of the bill, the House and the Senate have agreed to increase the coal excise tax, which has remained unchanged since 1976.

The bill also doubled the excise tax rates of all non-metallic minerals and quarry resources, and all metallic minerals including copper, gold and chromite from the current 2 percent excise tax to 4 percent; and on indigenous petroleum from the current 3 percent to 6 percent.

The excise taxes in metallic and non-metallic minerals and quarry resources were last amended in 1994.

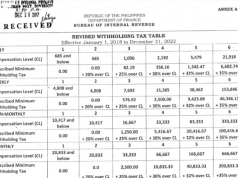

The TRAIN bill will reduce the income tax rate of individual income earners, which will give them higher take-home pay. It exempts the first P250,000 annual taxable income and raised the tax exemption for the 13th month pay and other bonues from P82,000 to P90,000.

However, the bill also imposes higher tax on fuel and fuel products, brand new automobiles, tobacco products and sugar-sweetened beverages.