MANILA – The government as issuer, and the Bank of China as lead underwriter, have signed an agreement spelling out the terms and conditions of the Philippines’ maiden issue of some 1.4 billion renminbi-denominated Panda bonds in the Chinese market.

Finance Secretary Carlos Dominguez III signed the underwriting agreement on behalf of the Philippine government with Bank of China chairman Chen Siqing in ceremonies held at Malacañan Palace.

Dominguez thanked the Bank of China for assisting the government in facilitating its planned Panda bond issue, and in organizing the Philippine Economic Briefing (PEB) last September in Shanghai to enable Philippine officials to present to Chinese investors the economic gains that the Philippines has made on the Duterte watch.

As lead underwriter, the Bank of China has committed to form an underwriting team that will purchase the Panda bonds that the Philippine government will issue, and then resell it to the Chinese market for a profit.

The underwriting agreement states that the Bank of China will serve as the bookrunner of the Panda bond issue.

“We thank the Bank of China (BOC) for taking the lead in helping us gain a foothold in the panda bond market. We are very happy that the BOC has come to our assistance. We also welcome the Bank’s efforts in bringing the Philippines’ growth narrative to the Chinese investors as demonstrated in the last Philippine Economic Briefing in Shanghai, and look forward to a strengthened partnership,” Dominguez said at the signing ceremonies.

According to National Treasurer Rosalia de Leon, “the Panda bond issue will diversify our funding sources and provide benchmarks for other Philippine issuers in the onshore market, particularly at this time that the renminbi is a reserve currency.”

“The bond issue will also complement the financial support from China for the implementation of critical infrastructure projects,” she added.

Dominguez has said the issuance of the Panda bonds will depend on market conditions, the possible business risks and the trend in dollar interest rates.

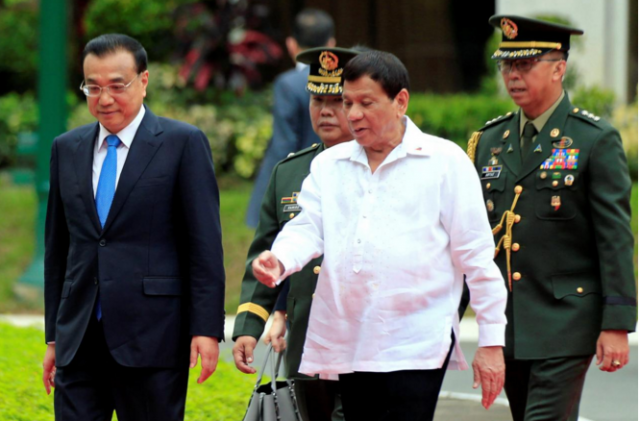

The signing ceremonies for the underwriting agreement, along with three other accords between the Philippines and China, were witnessed by President Duterte and Chinese Premier Li Keqiang, who was in Manila this week for the 31st Association of Southeast Asian Nations (ASEAN) Summit and Related Meetings.

The three other agreements include the financing cooperation agreement signed by Dominguez and Liu Liange, president of the Export-Import Bank of China, for two of the Philippines’ flagship infrastructure projects—the Kaliwa Dam-New Centennial Water Source of the Metropolitan Waterworks and Sewerage System (MWSS) and the Chico River Pump Irrigation facility of the National Irrigation Administration (NIA)—that will cover 85 percent of the total contract amounts of the projects.

Dominguez also inked a Memorandum of Understanding (MOU) with China Vice Commerce Minister and International Trade Representative Fu Ziying to “jointly identify and study” an indicative list consisting of the second basket of key infrastructure cooperation projects for possible Chinese financing.

Meanwhile, Dominguez and Vice Minister Fu also signed an Agreement on Economic and Technical Cooperation (grant agreement) on providing a 150-million renminbi (approximately $23 million) Chinese grant to aid the Philippine government’s quick recovery and reconstruction program for Marawi City.

Dominguez and the other members of President Duterte’s economic team went to China in September to hold the PEB and a “non-deal roadshow” for the planned Panda bonds issue.