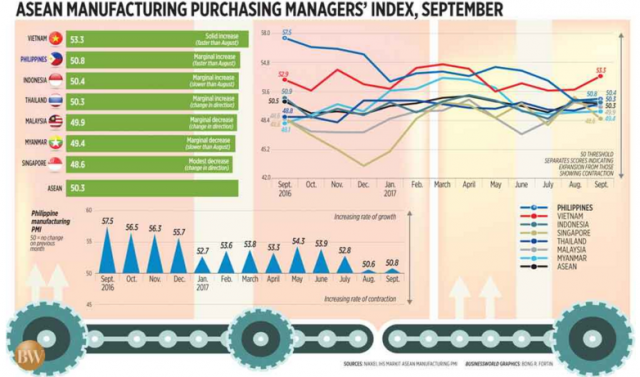

MANILA – The Philippines last month managed to land second place in Southeast Asia behind Vietnam in terms of growth of manufacturing activity, but the improvement was its second weakest since its inclusion in January last year in the survey IHS Markit conducts for Nikkei, Inc.

The seasonally adjusted Nikkei Philippines Manufacturing Purchasing Managers’ Index (PMI) picked up to 50.8 in September from August’s record-low 50.6, ending the quarter on a “subdued” note.

“Subdued growth of the Philippines manufacturing economy persisted at the end of the third quarter, as output expansion slowed further,” the report read.

“Order book gains continued to underwhelm relative to the historical trend — even as exports returned to growth — which weighed on hiring.”

The manufacturing PMI consists of five sub-indices, with new orders having the biggest weight at 30%, followed by output (25%), employment (20%), suppliers’ delivery times (15%) and stocks of purchases (10%).

Readings above 50 denote expansion while those below that mark point to contraction.

Compared to its peers in the Association of Southeast Asian Nations (ASEAN), the Philippines jumped over Indonesia and Singapore to land second as the performance of those other two countries worsened from August. Indonesia and Singapore saw their readings slip to 50.4 and 48.6, respectively, from 50.7 and 51.0 in the past two months.

The headline Nikkei ASEAN Manufacturing Purchasing Managers’ Index itself eased to 50.3 in September from August’s 50.4.

“The Philippines’ manufacturing economy ended the third quarter on a weak note, with the PMI signalling a second consecutive month of subdued growth,” the report quoted IHS Markit Principal Economist Bernard Aw as saying.

“The survey data pointed to further slowing in output growth and a modest sales trend while employment shrank again as firms indicated sufficient manpower to meet production demand,” he added.

“Despite the decrease in payroll numbers, capacity continues to be in abundance, which would weigh on hiring in the near future.”

The report noted that “September data showed that output volumes rose at the weakest rate since the survey started in January 2016,” blaming “a softening sales trend,” reduced overtime work, input shortages and rising cost of raw materials.

After declining in August, export orders increased last month even as “the degree of expansion was the mildest since the survey started in January last year.”

“The weak peso continued to pose a problem for manufacturers,” Mr. Aw added, referring to the peso’s persistent weakness against the greenback.

The local currency has depreciated 2.7% year-to-date to P51.08 to the dollar as of yesterday, surpassing the P48- to P50-to-the-dollar rate state economic managers have assumed for 2017.

“Not only did the cheaper currency fail to provide a boost to exports, it raised the cost of imports,” the report read.

“Coupled with supply shortages due to bad weather, costs for manufacturing inputs, especially in industrial metal and paper, increased further. There were also reports of rising cost inflation affecting production levels.”

The Bangko Sentral ng Pilipinas (BSP) on Friday last week estimated that inflation likely clocked 2.8-3.6% in September from August’s 3.1%, while BusinessWorld’s poll of 13 economists yielded a 3.2% median.

Production input costs rose at their fastest pace in five months, the report read.

Guian Angelo S. Dumalagan, Land Bank of the Philippines market economist, noted that “[o]ne thing surprising about the report though is that exports provided minimal boost to the overall manufacturing sector, despite depreciation of the peso and the general improvement in economic conditions abroad.”

“In part, this might be attributed to the fact that many of our exports are just re-shipments of imported products, which have become more expensive in local currency terms due to the peso’s weakening,” he said in an e-mail yesterday.

Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, said in an e-mail that the Philippine index’s “increase, though marginal, may signal an eventual recovery comparable to growth in 2016 with increasing domestic demand due to the fast approaching holiday season.”

“I still expect Philippine manufacturing to grow in 2017, especially as more and more investments are anticipated from the government’s thrust of increasing infrastructure spending plus the impact of further tax reform when corporate taxes are eventually adjusted to be comparable regionally,” added Mr. Dumalagan.

Survey data showed that a majority of respondents expected production to increase in the next 12 months on the back of new product launches, an improving economic climate, marketing activity and business expansion.

“[O]ptimism regarding output remained high, encouraging firms to increase purchases of inputs,” Mr. Aw said.