MUMBAI – Business confidence among Asian companies fell for the first time in three quarters in July-September as escalating geo-political tensions outweighed an improved performance by most economies in the region, a Thomson Reuters/INSEAD survey showed.

The Thomson Reuters/INSEAD Asian Business Sentiment Index, representing the six-month outlook of 86 firms, slipped to 69 for the September quarter from 74 three months before. The decline was the first drop from a previous quarter since the final quarter of 2016. A reading above 50 indicates a positive outlook.

While China, India and South Korea led the fall in sentiment in the third quarter, reflecting regional tensions and sluggish growth, most Southeast Asian economies and Australia put in a stable performance, limiting the downside in the overall index.

“Companies expressed concerns this quarter about trade and diplomatic tensions not only in the region but also in the world,” said Antonio Fatas, a Singapore-based economics professor at global business school INSEAD.

“This brought the index down, in a reflection of cautiousness because of the potential risks that could derail the current state of the economy,” he said.

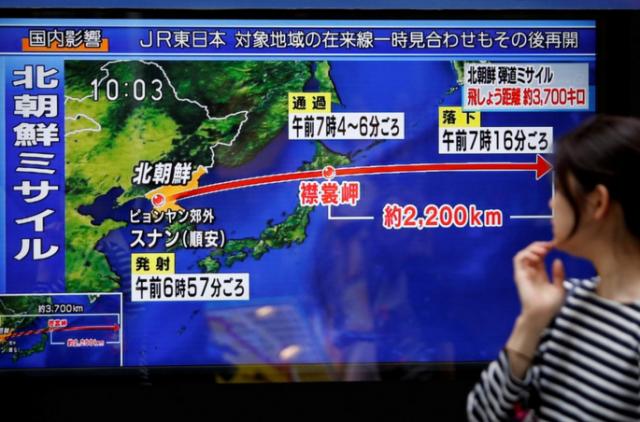

South Korea’s sub-index fell the steepest among its peers in the survey, dropping to 50 from 75 in the previous quarter. The country has been rattled by North Korea’s series of nuclear tests and missile launches, although a war on the Korean peninsula is seen as unlikely.

Trade friction with China has also risen over Seoul’s deployment of a US anti-missile system to counter the North Korean threat, as Beijing fears the system’s radar can penetrate its territory.

China, upon which much of Asia depends for trade, saw its subindex fall to 63, its lowest since the last quarter of 2015. Its gross domestic product rose 6.9 percent in the second quarter but growth is expected to slow on tighter debt regulations.

India fell to 63 from 82 in April-June, a level last seen in the second quarter of 2013. Growth at Asia’s third-largest economy slowed to its lowest in three years to 5.7 percent in April-June and is expected to stay muted on a lack of private investment.

Australia’s sub-index inched up to 69 from 67 in the June quarter, and Singapore’s rose to 64 from 62. Sentiment climbed the most in Indonesia in the September quarter, with a 17 point jump in its sub-index to 100, its highest since the second quarter of 2013, though the survey pool was small with only three firms participating.

The sub-index for three other economies – Malaysia, Philippines and Taiwan – remained unchanged over the previous quarter.

STATUS QUO AHEAD?

The pace at which global central banks tighten their accommodative monetary policies is set to be one of the biggest factors for Asia business sentiment in the quarters ahead.

“More than geo-political tensions, policy normalization by global central banks and firming up of oil prices are a bigger issue for Asian economies,” said Radhika Rao, chief economist at DBS in Singapore.

While Canada has already hiked rates twice in recent months and the Bank of England warned of rate hike possibilities, all eyes are now on the U.S. Federal Reserve’s decision on Wednesday where it is likely to take another step toward policy normalization.

But a major shift in business sentiment either way is unlikely.

”The technology-oriented and commodity exporting countries will do well in Asia but overall I expect a status quo in sentiments going ahead, barring a reversal in oil prices,” DBS’s Rao said.

The survey showed that while the proportion of respondents with a positive bias fell to 47, the lowest level since the December quarter of 2016, companies which were neutral rose to 45, the highest level since the March quarter of 2016.

Sectors including retail, metals, real estate and technology showed bullish trends while others like autos, construction, healthcare and transport were more subdued.

Corporates such as survey respondent Kossan Rubber Industries of Malaysia cited exchange rates and interest rates as the key risks going ahead. While maintaining that it was cautiously positive, given increasing global demand for gloves, Kossan was worried about “escalating production cost due to higher raw material cost, energy, labor and volatile exchange rate”.

FOR GRAPHIC on “Biggest perceived risks,” click here.