MANILA – The overall hike in prices of widely used goods and services could have quickened in August to its fastest pace in three months, partly as measures to contain a bird flu outbreak crimped supply of some poultry products, analysts said in a BusinessWorld poll last week, even as they said this would not be enough to prod the central bank to raise interest rates anytime soon.

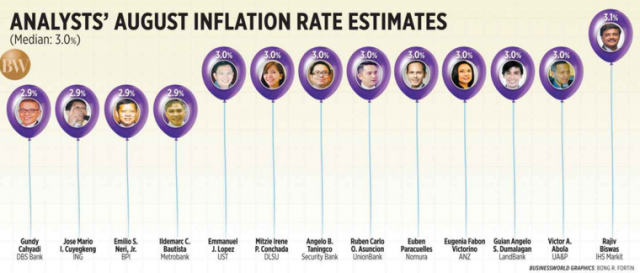

A poll among 13 economists yielded a median inflation estimate of 3.0% for August, which if realized would be faster than July’s 2.8% and the year-ago 1.8% on the back of higher fuel, electricity and food costs. It would also be the fastest increase since May’s 3.1%.

The estimate likewise falls at the middle of the 2.6-3.4% range given by the Bangko Sentral ng Pilipinas (BSP) Department of Economic Research last week.

The Philippine Statistics Authority is scheduled to report official inflation data on Tuesday.

“Our Economic Research Unit is looking at 3.0% for August inflation. This is on the back of higher fuel prices and the impact of the weaker peso on the prices of imported consumer goods,” Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, said via e-mail.

“In addition, the temporary impact of the bird flu scare on poultry production — with the consequence of higher pork and beef prices as alternatives — was also a significant factor on the uptick of the level of prices.”

The higher oil prices also spurred increases in electricity rates and transport costs, added Security Bank Corp. economist Angelo B. Taningco.

The Agriculture department ordered the culling of over 600,000 fowl in Pampanga and Nueva Ecija after it discovered cases of avian influenza, leading to a sharp drop in poultry prices as consumers feared infection.

Recent weather disturbances may have also pushed prices upward, according to Nomura’s Euben Paracuelles.

The economists also pointed out that the continued depreciation of the peso likely helped push prices upward, but noted that the impact remains relatively small. The peso weakened to fresh 11-year-lows last month, although BSP Governor Nestor A. Espenilla, Jr. has assured that the currency will not free fall versus the dollar as economic conditions remain stable.

“A low print should demonstrate that even a near 10% year-on-year PHP depreciation has minimal pass-through effect on inflation. This should also imply that overheating concerns are misplaced and that the bigger challenge for the economy is sustaining capacity expansion through continuous absorption of much-needed capital goods imports,” said Emilio S. Neri, Jr., lead economist at the Bank of the Philippine Islands.

The analysts’ estimates assure that inflation will remain within the central bank’s 2-4% target band and keep the year-to-date average below the 3.2% forecast for the entire year, leaving the BSP with no reason to adjust borrowing rates anytime this year.

“We don’t expect any change in the policy rates for the rest of the year given benign inflation expectations,” said Ildemarc C. Bautista, vice-president and head of research at Metropolitan Bank & Trust Co.

However, two economists said they still expect one rate hike from the BSP next quarter, citing rising interest rates and the need to cap rapid credit growth.

The Monetary Board kept interest rates unchanged in its Aug. 10 review, with inflation seen to remain manageable alongside upbeat domestic economic activity. Monetary authorities are scheduled to review policy settings on Sept. 21.