TOKYO — Japan’s labor market is getting so tight that companies are starting to convert contract and part-time workers into full-time, regular employees to prevent them from leaving — a move that could lift wages and spending but squeeze profits.

The trend is a reversal from the decades-long practice here of hiring cheaper contract workers who receive few benefits and are easier to hire and fire. They now make up more than a third of the workforce.

Companies are willing to reverse course and take on the extra costs that come with regular employees because of the tightest labor market since the 1970s, as Japan’s population ages and declines.

“We consider this as necessary investment for the future rather than a burden,” said Mayumi Kuroda, a spokeswoman for Credit Saison Co Ltd., a credit card issuer that plans to turn 2,200 part-timers and other contract workers into regular employees in mid-September.

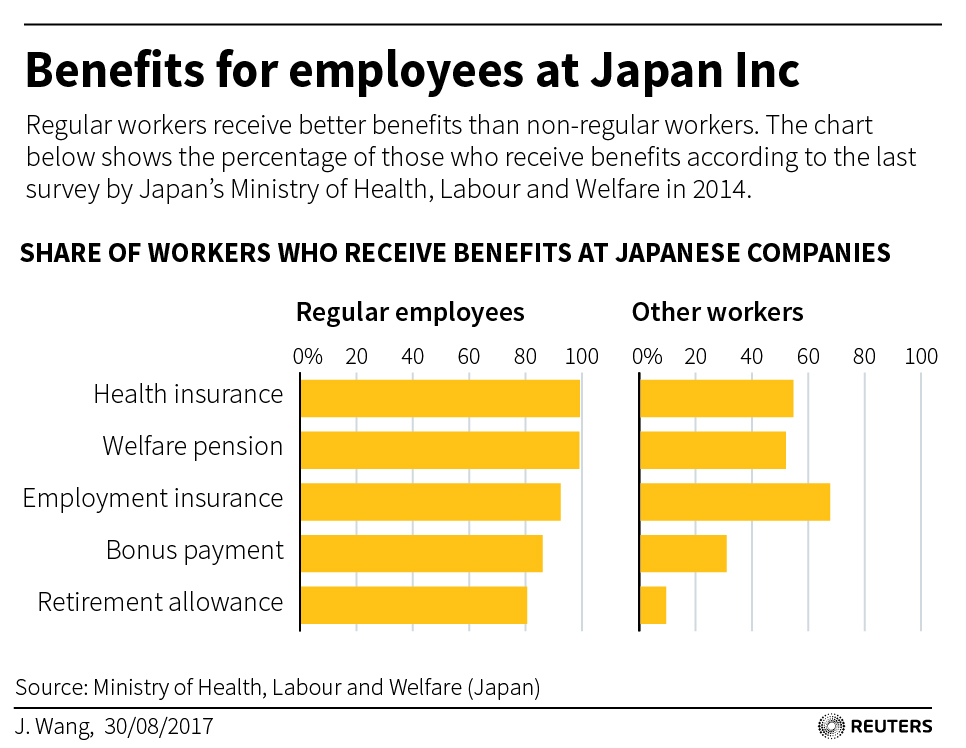

They will qualify for bonuses and benefits, such as retirement plans, when they join the regular ranks. The company won’t disclose the cost but predicts it won’t have a big impact on earnings, Kuroda said.

“We hope this will help employees keep up motivation and come up with innovations,” she said. “If we fail to deliver, only the cost will rise.”

Last year, the average monthly pay for regular workers was 321,700 yen ($2,932) while for contract workers it was 211,800 yen ($1,924), so a change in status can mean a big jump in pay plus benefits workers weren’t previously receiving. That isn’t across the board – some will see little change in their compensation but will get more job security.

Increased labor costs may squeeze corporate profits, forcing companies to either raise prices or improve labor productivity.

“We are fully aware of the risk that keeping employees as regular workers will raise fixed personnel costs, but I doubt pursuing profits by exploiting workers will boost creativity,” said Takayoshi Hontao, chairman of Going.com, which develops and operates business management systems. It has turned 10 of its contractors into full-timers, making all of its 40 employees regulars.

Job security

One of the biggest positives is that it gives employees a sense of job security.

“When the company offered me a permanent job last year, I felt I was needed, which has increased my motivation. It opened the doors for my promotion to a section chief, and a pay raise,” said Mami Tanaka, a 29-year-old employee at Going.com.

Japan Post Holdings Co Ltd. has offered full-time jobs to 3,145 contract employees this fiscal year, and Fast Retailing Co Ltd., which includes the Uniqlo brand, has done the same with about 16,000 part-timers.

At Japan Airlines Co. Ltd., about 1,100 cabin attendants on contracts were offered permanent full-time jobs last year, following a similar move by its domestic rival ANA Holdings Inc.

Some small companies in need of specialized workers are also following suit.

“It’s very difficult nowadays to secure plasterers at a time when our business is busy thanks to the construction boom ahead of the Olympics,” said Muneaki Harada, president of plastering firm Harada Sakan.

“There’s a risk of fixing costs, but I believe benefits outweigh costs,” he said.

Labor law revisions

The trend is expected to accelerate toward April 2018 when a revised labor contract law starts forcing companies to provide permanent status for temporary workers who have served more than five years, if the workers request it.

The jobs-to-applicants ratio among full-time permanent employees hit a record high of 1.01 in June and July, meaning there was slightly more than one full-time, regular job per applicant, government data shows. Including non-regular workers, the ratio was 1.52, or 1 1/2 jobs per applicant, the highest level since 1974.

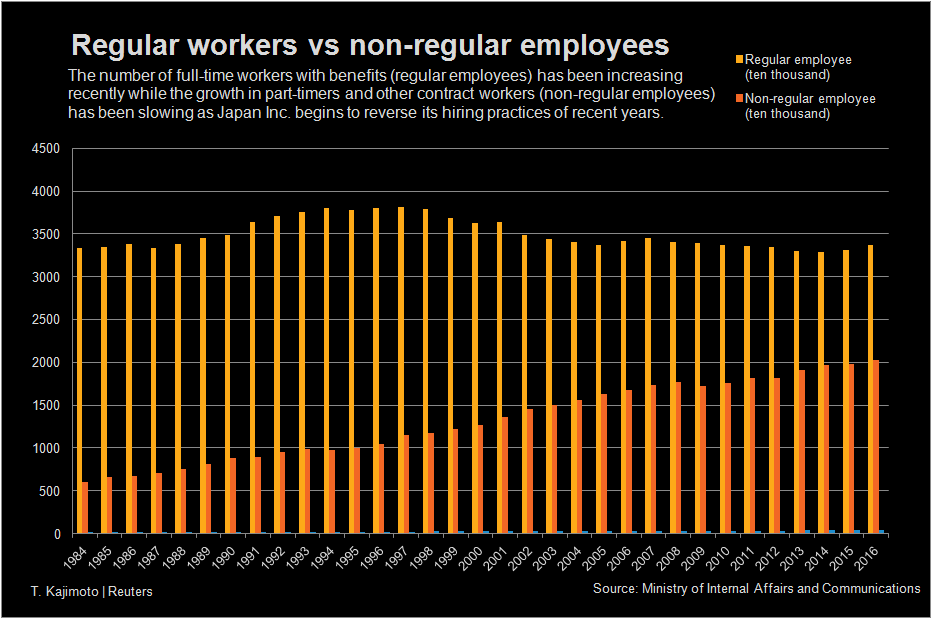

Japan’s lifetime employment system, which undergirded its economic growth for decades, has frayed since the early 1990s after the country’s asset bubble burst.

Since then, the share of non-regular workers has almost doubled as companies saddled with excess capacity, debt and excess workers have replaced regular employees with cheaper contract workers.

But that has curbed overall wages and hurt consumer spending.

“The competition for able workers will intensify, which will benefit those who are willing to work full-time with better working conditions and job security, helping spur consumption,” said Hiroshi Watanabe, economist at Sony Financial Holdings.

Nationwide, the number of full-time permanent workers stopped falling for the first time in eight years in 2015. Since then, it’s grown about 800,000 to reach 33.7 million, according to the labor ministry.

Last year, the share of non-regular workers stopped rising for the first time in seven years. It is still hovering at a record 37.5 percent, reflecting the rising number of the elderly who are hired as contract workers after retirement.

The unfolding trend is “a step in the right direction,” said Takahiko Uesugi, a human resources section chief at Treebell Co. Ltd., a computer system services provider that has turned 90 non-regular workers into regular workers in the past two years with the help of government subsidies.

It plans to offer permanent jobs to 20 more in the coming year. About 400 of its 600 employees are regular workers.

“The IT industry has relied so much on contract workers. It gives a bad impression that engineers are working under a poor labor environment,” Uesugi said. “It has gone too far.”