MANILA – The inclusion of the oil excise tax in the Duterte administration’s tax reform program is not the sole factor to blame for the rise in oil prices, the Department of Finance said Thursday.

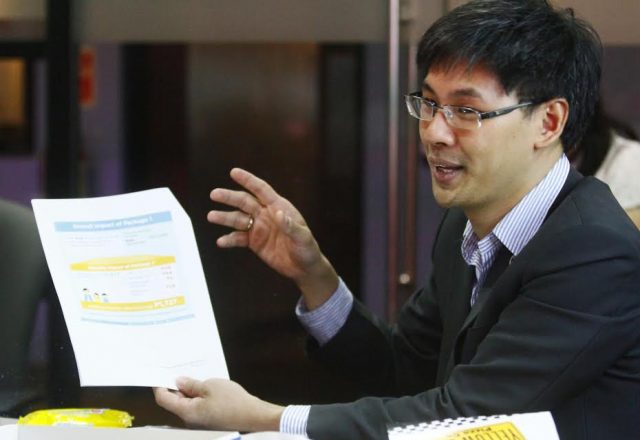

“Factors such as weather, stocking, income, lower poverty, basic supply and demand and even profiteering are the many factors that affect the final price and should not be blamed on tax alone,” DOF Undersecretary Karl Kendrick Chua told the Senate Committee on Ways and Means during its 13th hearing on the tax program.

As the Angara panel opened the hearing, hundreds of activists from groups led by the Freedom from Debt Coalition (FDC) marched on the Senate to protest the tax reform package, bundled under the so-called “TRAIN” for Tax Reform for Acceleration and Inclusion.

They singled out as being among the “anti-poor provisions of TRAIN the fuel excise tax – which the House version wants imposed on a “3-2-1” formula, or P3 on the first year, an additional P2 on the second and P1 on the third year of implementation. This raises fuel prices to a total P6/liter for diesel, kerosene and bunker fuel, and P10/liter for gasoline. Kerosene, diesel, LPG and bunker fuel are currently levied zero excise tax, the FDC protesters pointed out.

At the Senate hearing, however, Undersecretary Chua defended the TRAIN before senators. “There are many factors that affect prices. An increase in oil price does not necessarily lead to higher prices or inflation.”

Chua explained that oil excise tax reform “must be seen as part of the overall package” which includes the reduction of personal income tax.

Contrary to critics’ impression, he said, the reform “is really very equitable, pro-environment and pro-health.”

The DOF official claimed that higher oil excise will eventually also help reduce pollution and congestion, which he said were two factors that really waste time and health.

Moreover, he offered the assurance that a few tax exceptions will protect the poor.

President showed flexibility

It may be recalled that President Duterte, during his second State of the Nation Address, urged the Senate to pass his proposed comprehensive tax reform package “in full”.

Senators had earlier expressed reluctance to pass in full the House version of the package, citing several concerns such as the effect of petroleum taxes and excise taxes on poor sectors.

However, Senate Minority Leader Franklin Drilon last week revealed that the President has accepted that “flexibility” is needed on the part of the executive to ensure the passage of the proposed tax package.

Drilon stressed that the President, in a recent meeting with Congress leaders, had “left it to the good judgment” of the legislature and consultation with the Department of Finance (DOF) to determine what appropriate tax structure can be passed.

“He (the President) realizes that the Senate as a collegial body will have to seek the views of each senator. He was open to amendments,” he added.

The House of Representatives approved on May 31 the first package with 246 votes in favor, nine against, and one abstention.

The tax-reform package seeks to lower personal income tax rates, expand the value-added tax (VAT) base, raise excise taxes on petroleum and automobiles, impose an excise tax on sugar sweetened beverages and ease the rates of estate and donor’s taxes.

Urban poor, labor protest

Activists and leaders from urban poor and labor groups massed up at the Senate grounds Thursday to protest oil and petroleum excise tax hikes in government’s bid to raise tax revenues and offset the reductions in income taxes.

Raising placards calling the measure “anti-people” and “anti-poor”, they urged the Senate not to endorse in full the House Bill 5636.

The mobilization led by FDC was timed with a Senate hearing on TRAIN’s planned imposition of higher excise taxes on oil and petroleum products (on top of the 12% Value Added Tax).

“The poor and low-waged get no benefit from the income tax cuts because they are already exempt to begin with, but they will be hit by the ensuing waves of price hikes on food, housing, electricity, transportation and other goods and services if TRAIN is passed into law,” said Prof. Ed Tadem, FDC president.

“This will surely have a domino effect on basic goods that we already have difficulty in providing our families,” added Flora Santos, president of the Metro Manila Vendors’ Alliance. “And the poor, such as ourselves in the informal sector, will be hit hardest.”

Tadem questioned the fuel excise hike as well as other TRAIN provisions he called “regressive” and “inequitable” as they take away a greater share from poorer people’s earnings as compared to wealthier groups.

“Rather than imposing more regressive consumption taxes that hurt the poor and middle classes, the government should instead look inward and plug policy and administrative holes that result in huge losses of potential revenue,” he said. Among these are the income tax holidays liberally extended to multinational corporations, unchecked technical smuggling and continued interest payments on fraudulent project loans.

“Most of these don’t need new legislation, just the political will to recover trillions of pesos in relinquished government incomes—abundantly much more than what can be generated from TRAIN,” Tadem said.

The group urged the public to stay vigilant over the legislative process leading to TRAIN’s enactment. “It is now for the Senate to prove itself true to the interests of the majority of the Filipino people who remain struggling in impoverishment and deprivation,” said Mae Buenaventura of the Asian Peoples’ Movement on Debt and Development, which wages a regional campaign for tax and fiscal justice. “Tax reform should lead to alleviating and not increasing the burdens of the poor.” (With reports from Ma. Angela Coloma-OJT/PNA)