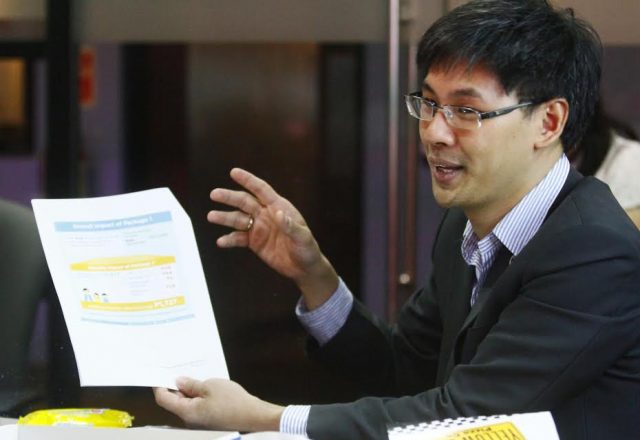

MANILA – Nine out of 10 Filipino individual taxpayers will enjoy a 20-percent boost in their purchasing power once the personal income tax cuts approved by the House last month are enacted, Buhay Rep. Lito Atienza said Sunday.

“The tax reductions are bound to rev up consumption spending by middle class families, which may well help counteract possible delays in new business activities due to the recent declaration of martial law in Mindanao and the Battle of Marawi,” Atienza said.

The Senate is expected to pass the tax reform package soon after the second regular session opens on July 24, according to Atienza, the House senior deputy minority leader.

Department of Finance officials had earlier projected on getting the Senate’s nod for the package of reforms by August or September, given he certification given by President Duterte tagging it as urgent legislation.

Quoting projections made by leading online stockbroker COL Financial Group Inc., Atienza said the slash in personal taxes, mostly benefiting salaried employees, “will lead to a 20-percent increase in disposable income for 93 percent of taxpayers.”

“Calculations made by independent entities such as COL Financial tend to be more reliable compared to estimates from other sources, including official sources,” Atienza said.

The House passed on third and final reading on May 31 the tax cuts, as contained in House Bill (HB) 5636, bringing it a step closer to being passed into law.

Under the bill, effective July 1, 2017, those receiving compensation income not over P250,000 annually shall be exempt from taxes; while those getting over P250,000 but not over P400,000 shall be taxed 20

percent of the excess over P250,000.

Those earning over P400,000 but not over P800,000 shall be taxed P30,000 plus 25 percent of the excess over P400,000, while those grossing over P800,000 but not over P2 million shall be taxed P130,000 plus 30 percent of the excess over P800,000.

Those bringing in over P2 million but not over P5 million shall be taxed P490,000 plus 32 percent of the excess over P2 million, while those making over P5 million shall be taxed P1.45 million plus 35 percent of

the excess over P5 million.

Most self-employed individuals as well as professionals shall also be taxed less on gross sales or receipts.

The tax cuts would be offset by additional revenues from a bigger value-added tax (VAT) base and higher taxes on sugary drinks, petroleum and automobiles.

The surplus revenues would help fund a 10-point socioeconomic strategy for all-encompassing growth, including a highly aggressive public infrastructure-building program, according to the government’s economic cluster.

HB 5636 forms part of a broader Tax Reform for Acceleration and Inclusion (TRAIN), which envisions a new tax system that is simpler, fairer, and more efficient.

Under TRAIN, the country’s new tax regime would have low rates and a large base, and help promote investment, job creation and poverty alleviation.

The lowering of corporate income tax rates, which the House has yet to pass in a separate bill, is also being eyed under TRAIN to help encourage incremental investment spending.