Under the Duterte administration’s priority Tax Reform for Acceleration and Inclusion (TRAIN) bill, the excise tax on oil will be raised by P6, gradually over three years – by P3 in the first year; P2 in the second; and P1 in the third – and indexed yearly after the third year.

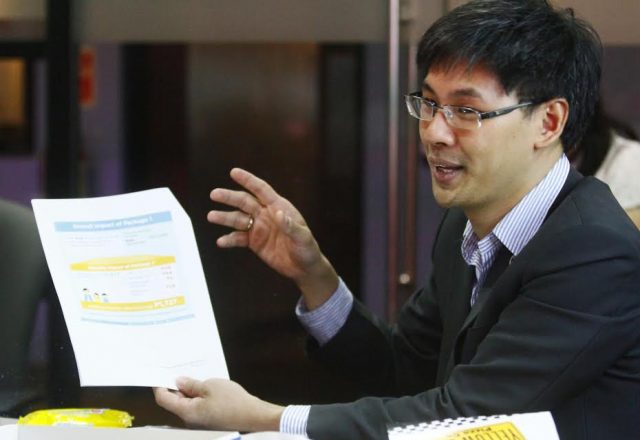

Finance Undersecretary Karl Chua pointed out in a briefing at the TV5 Media Center in Mandaluyong City Thursday that 51 percent of fuel is consumed by the top 10 percent of Filipino families in terms of income decile (or those earning at least PhP113,000 per month); while 13% of fuel is consumed by the wealthiest 1% of Filipino families (those earning at least P288,000 per month), and which also corresponds to the amount of fuel consumed by the poorest 50 percent.

Those who consume more will pay more tax, Undersecretary Chua said, compared to those who consume less.

DOF Undersecretary Karl Chua urges the public to look at the tax reform as a package that would benefit 99 percent of Filipinos. It would be easy to say one likes the lower income tax but not the excise taxes, but all reforms have trade-offs; by putting them in a package, all factors could be harmonized and balanced better.

Nevertheless, the tax reform measure will still have an impact on the poor, which is why the government has at least five measures associated with this measure to alleviate their burden.

Finance Undersecretary Karl Chua enumerated these.

1. Targeted Cash Transfers

The government will give the poorest 50 percent of households P200 each every month for one year. Ten million households will benefit from these targeted cash transfers. According to Chua, this will ensure that they don’t become poorer due to possible nominal downstream increases in prices.

The period covered is only 12 months because the targeted cash transfers are just a temporary solution while waiting for the “real social services” to take hold that will make their lives better, Chua explained.

2. Pantawid Pasada

All drivers of “regulated, franchised, and registered” public utility vehicles, most of them jeepneys, will be given cash cards. That way, when they buy their diesel, they can offset the increase in oil prices, and they don’t have to pass on fare increases to their passengers.

3. Jeep Modernization Program

This will replace 220,000 jeepneys 15 years and older that are “dirty, inefficient, and unsafe,” Chua said.

Revenues from the tax reform will subsidize the purchase of more efficient jeeps. According to The Philippine Star, the state-run Land Bank of the Philippines established a P1-billion credit facility in May in relation to the program.

4. Pantawid Kuryente

Only about seven percent of the energy source of isolated Philippine islands is derived from diesel and bunker fuel. Because they will have to pay for these at a higher cost, those consuming 100 kilowatt hours per month will have “a lifeline subsidy,” according to Chua. The rich, or those who can afford, will contribute more for the government to provide this subsidy.

5. National ID/Social Welfare Card

A single identification card will be the basis for all subsidies, covering disaster survivors, persons with disabilities, and senior citizens, among others. This will enable the Department of Social Welfare and Development, as well as local government units, to better respond to their needs, especially in times of crises or when there is a need for subsidy, Chua said.

The House of Representatives passed the TRAIN bill in May, and Undersecretary Chua expects the Senate to take its cue from President Rodrigo Duterte, who certified it as an urgent measure, and move quickly.

Chua urged the public to look at the tax reform as a package that would benefit “99 percent” of Filipinos. It would be easy to say one likes the lower income tax but not the excise taxes, but all reforms have trade-offs. By putting them in a package, all factors could be harmonized and “balanced” better, he said.

He also underscored that citizens should look beyond tax reform and pay attention to how the revenue is being spent. The true test of the process, he pointed out, is whether it translates to real benefits for the people. In that sense, tax reform is like the wedding ceremony in relation to the actual marriage, where the real hard work applies, he quipped.

Finally, he reminded taxpayers that tax reform was an investment in their future. He cited the example of two students – one poor, the other not so poor.

One of them has a nice house, enjoys electricity, running water, and can therefore study in an environment that was conducive to learning.

The poor child has to walk a long way to school and cross rivers, and does not have electricity to power lights and electric fans. How can the poor child then catch up with the other one?

Therefore, tax reform is about “laying the foundation for a better future for all Filipinos,” Chua said.

His view was, in his words, simple. The government has to make sure that its citizens, especially the poor, were healthy, so that they could finish school and land good jobs. If the tax reform does not push through, it would be harder for the poor to improve their lives.

He related the how his son, at one year old, was hospitalized for pneumonia and diarrhea. The family was lucky to afford care at a private hospital, where he was confined for four days. The baby had a private room, and was cared for by nurses and doctors.

But this is hardly the same kind of reality for the poor, the disadvantaged, Chua said.

He realized how lucky he and his son were.

“He got the best treatment,” Chua said. “We wish the same for everybody. So, this tax reform is really about the next generation.”