MANILA, Philippines – Is there a win-win situation when it comes to designing a tax system?

The Comprehensive Tax Reform Program (CTRP) bill recently approved by the Ways and Means Committee of the House of Representatives results in a lower income tax rate on the one hand, but, on the other, consumers end up shouldering higher cost of goods and services from new or additional taxes that have to be imposed in return.

The bill was approved at the committee level on Wednesday. It will go to the appropriations committee for review and then returned to the mother committee before being referred to the plenary for deliberation.

According to ACT Teachers partylist Representative Antonio Tinio, the lower income tax means foregone revenues to the tune of P140 billion, as the result of slashing the effective personal income tax rate from the prevailing 32 percent to 25%.

However, the new and additional taxes to be imposed by the tax reform measure stand to rake in around PhP250 billion in revenues for the government, including excise tax on oil (around P120 billion); expanded Value Added Tax coverage (P90 billion); and, tax on the purchase of new vehicles (around P40 billion).

“This is not just about recouping the revenue loss (from lower income tax), the objective is to generate more money to fund the government infrastructure projects,” Tinio said.

“After death penalty, Congress is now bent on imposing new taxes,” he said. “Death and taxes seem to be the priorities of this administration,” he added.

He described the proposed measure as “anti-poor,” since not many of them will benefit from the lower income tax as they are already tax-exempt if they are minimum wage earners.

This means they would be hit hard by the concomitant new taxes under the new regime, that, in turn would being about higher prices of goods and services, such as diesel and cooking gas.

Anakpawis partylist Rep. Ariel Casilao said part of the higher expected revenue would be generated from rescinding VAT exemptions on 79 goods and services that are currently enjoying zero VAT.

Casilao said the Ways and Means Committee has been silent on the amount of additional revenue that could be generated from lifting the VAT exemption from these goods or services.

“They are not divulging the details because that would create a domino effect, a reaction from the sectors affected and covered by the 79 exemptions,” he said.

One sector that has a raised a howl was the cooperatives sector, whose 14 million members all over the country will suffer if their savings and loans would now be taxed.

During the deliberation of the committee, Tinio said, it came to light that taxing the cooperative sector would rake in only between P3 billion and P4 billion, but at the expense of millions of members of cooperatives.

Tinio said Congress intends to pass the tax package bill into law within the year, for implementation starting January 2018.

In a statement, Department of Finance (DOF) Undersecretary Karl Kendrick Chua lauded the “substantial progress” achieved by Congress in tackling the bill.

“We remain hopeful that, with this committee vote for the substitute bill, the tax reform measure can still be approved at least by the House of Representatives before the Congress ends its first regular session this June. We will also convince the plenary to include some original provisions that were removed,” Chua said.

CTRP that aims to overhaul the country’s tax code by making the system simpler, more efficient and fairer especially for the poor and low-income Filipinos, DOF explained.

Among the key features of the bill are the following:

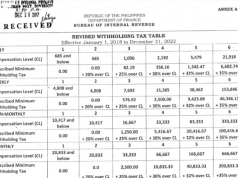

1) Lowering of personal income tax (PIT) rates as proposed by the DOF but indexed to cumulative Consumer Price Index (CPI) inflation every three years;

2) Flat rate of 6 percent for estate and donor’s taxes;

3) Broadening the tax base by removing special laws on VAT exemptions, including those for cooperatives, housing and leasing, but retaining exemptions for seniors and persons with disabilities;

4) Staggered “3-2-1” excise tax increase for petroleum products from 2018 to 2020 but with no indexation to inflation, and liquefied petroleum gas (LPG) used as feedstock to be exempted from the hike;

5) Five-bracket excise tax structure for automobiles with a two-year phase-in period for the tax increases; and

6) Earmarking 40% of the proceeds from the fuel excise tax increase for social protection programs during the first three years of the tax reform measure’s implementation.

The zero VAT rate was retained for the renewable energy sector and limited to direct exporters, pending the establishment of the DOF-proposed cash refund system, in which refunds can be obtained by the beneficiary-taxpayers within 90 days of their application for such exemptions, Chua said.

For the self-employed and professionals within the VAT threshold of P5 million, Chua said the substitute bills require them to pay an 8 percent tax on gross sales or receipts in lieu of the income and percentage taxes.

The tax for those above this VAT threshold will be based on the 30% corporate income tax rate with minimum tax, Chua said.

Chua said the Optional Standard Deductions (OSD) was retained at 40 percent of gross sales/receipts under the substitute bill.

The bill also adopted the DOF proposal to subject lottery and sweepstakes winnings from the Philippine Charity Sweepstakes Office (PCSO) to a 20 percent passive income tax in lieu of the lower 5 percent prize fund tax.

Another DOF proposal adopted under the bill was the removal of the 15 percent tax rate for the employees of the Regional Operating Headquarters (ROH) of corporations, which are foreign business entities whose purpose is to service its affiliates, subsidiaries or branches in the Philippines and other foreign markets.

On oil excises, Chua said the original proposal of staggering the P6 increase to P3 in the first year, P2 in the second year and P1 in the third year was adopted, but with no indexation to inflation thereafter.

For automobile excises, five brackets were adopted (based on price levels) under the substitute bill, which also set a two-year phase-in period for its implementation, he said.

Pickups are exempted under the substitute bill, along with hybrid cars if these vehicles can run 30 kilometers on a single charge.

Click and watch the video report below from News5’s beverly Natividad: